Precious metals like gold and silver have long been regarded as reliable tools for wealth preservation, especially during periods of financial turbulence. Unlike paper currencies or volatile stocks, these metals hold intrinsic value that transcends economic crises, inflation, and geopolitical uncertainties. Their stability, rarity, and universal acceptance make them invaluable assets for individuals and institutions seeking to safeguard their wealth. This article explores how gold and silver protect wealth during financial instability and why they remain essential components of a diversified investment portfolio.

The Role of Precious Metals in Wealth Preservation

Gold and silver are tangible, finite resources that have served as stores of value for centuries. Their unique properties allow them to retain purchasing power and provide financial security when other assets falter.

1. Intrinsic Value and Universality

Precious metals are valued for their inherent qualities, including durability, malleability, and rarity. Unlike fiat currencies, which can be devalued through excessive printing, gold and silver retain their value across borders and generations.

- Example: A gold coin minted centuries ago still holds significant value today, regardless of economic or political changes.

This universality makes precious metals a dependable hedge against financial instability.

2. Independence From Financial Systems

Gold and silver operate outside the conventional financial system, meaning their value is not directly tied to stock markets, interest rates, or government policies. During bank failures or market crashes, precious metals often rise in demand as safe-haven assets.

- Impact: When stock markets plummet, gold prices typically increase, offsetting losses in other investments.

3. Hedge Against Inflation

Inflation erodes the purchasing power of fiat currencies, making it harder to maintain wealth over time. Precious metals act as a hedge by retaining their value even as currency values decline.

- Example: During periods of high inflation, such as the 1970s in the U.S., gold prices surged as investors sought refuge from depreciating dollars.

How Gold Protects Wealth During Financial Crises

Gold is often referred to as a “crisis commodity” because its value tends to increase during periods of financial turmoil. Investors turn to gold as a stable and liquid asset when other markets falter.

1. Stability During Market Volatility

Gold’s historical performance demonstrates its ability to retain value during economic downturns. It serves as a counterbalance to volatile assets like stocks and bonds.

- Example: During the 2008 global financial crisis, gold prices rose by over 25% as equity markets collapsed.

This stability makes gold an essential asset for risk-averse investors.

2. Diversification and Risk Management

Gold’s low correlation with traditional financial assets makes it an effective diversification tool. Including gold in an investment portfolio reduces overall risk and enhances resilience during market fluctuations.

- Impact: A portfolio with 10-20% allocation to gold often outperforms during periods of economic instability.

3. Global Acceptance and Liquidity

Gold is universally recognized and accepted, making it easy to trade or liquidate during emergencies. Its high liquidity ensures that investors can access cash quickly without significant value loss.

- Example: Central banks hold large gold reserves to ensure financial stability and currency backing.

How Silver Safeguards Wealth During Uncertain Times

While gold is often the primary focus for wealth preservation, silver also plays a crucial role. Its affordability and industrial applications make it a versatile asset for protecting wealth.

1. Affordability and Accessibility

Silver is more affordable than gold, making it an attractive option for individual investors seeking to preserve wealth without significant upfront costs.

- Example: A smaller investor can purchase silver bars or coins to hedge against inflation and economic uncertainty.

2. Dual Role as Industrial and Precious Metal

Silver’s use in industries such as electronics, solar energy, and medical devices provides additional demand drivers beyond its role as a precious metal. This dual role stabilizes silver prices even during economic downturns.

- Impact: The growing demand for renewable energy has increased silver’s value in recent years, further enhancing its investment appeal.

3. Complementary Asset to Gold

Silver complements gold in a diversified portfolio, offering similar wealth preservation benefits while being more volatile, which can lead to higher returns during market recoveries.

- Example: Silver prices often rise more sharply than gold during bull markets for precious metals, providing additional profit opportunities.

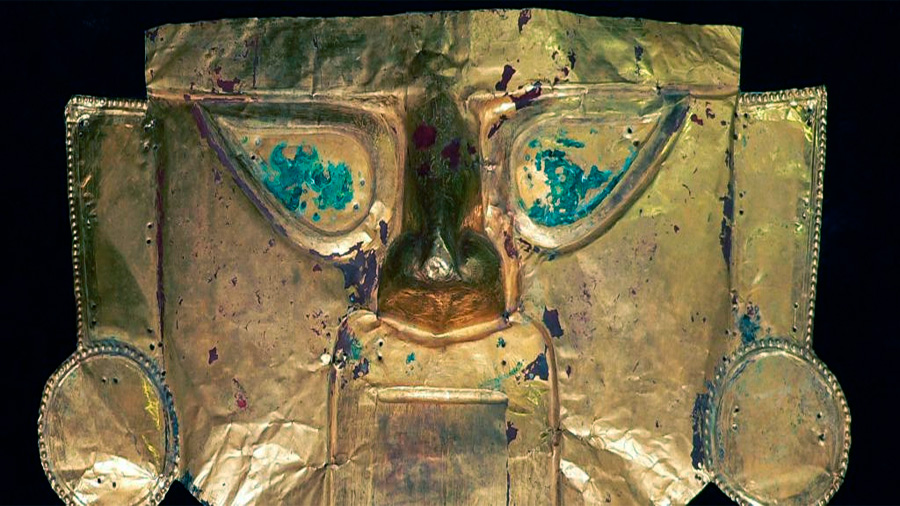

Historical Examples of Precious Metals in Times of Turmoil

Throughout history, gold and silver have demonstrated their ability to protect wealth during financial crises and geopolitical conflicts.

1. The Great Depression

During the Great Depression, gold prices remained stable as currencies devalued and stock markets crashed. Many individuals and central banks relied on gold to preserve wealth amidst widespread economic uncertainty.

2. The 2008 Financial Crisis

As the global financial system teetered on collapse, gold prices surged from approximately $700 per ounce in 2008 to over $1,800 by 2011. Investors turned to gold as a safe haven, highlighting its effectiveness in wealth preservation.

3. COVID-19 Pandemic

The COVID-19 pandemic caused economic disruptions worldwide, driving gold prices to record highs of over $2,000 per ounce in 2020. Silver also experienced significant gains, reflecting increased demand for precious metals during uncertainty.

Incorporating Precious Metals Into Your Wealth Strategy

For individuals and institutions, integrating precious metals into a wealth preservation strategy involves careful planning and diversification.

1. Determine Allocation Levels

Experts recommend allocating 5-20% of an investment portfolio to precious metals, depending on individual risk tolerance and financial goals. A balanced approach ensures stability without overexposure.

2. Choose the Right Form

Investors can choose from various forms of gold and silver, including:

- Physical Assets: Bars, coins, and jewelry offer tangible wealth preservation but require secure storage.

- Exchange-Traded Funds (ETFs): ETFs provide exposure to gold and silver without the need for physical storage.

- Mining Stocks: Shares in gold and silver mining companies offer higher returns but come with greater risk.

3. Monitor Market Trends

Staying informed about economic conditions, inflation rates, and geopolitical events helps investors make timely decisions regarding precious metal investments.

Conclusion

Gold and silver have proven their value as tools for safeguarding wealth during financial turbulence. Their intrinsic value, independence from financial systems, and universal acceptance make them indispensable assets for individuals and institutions facing economic uncertainty. By understanding the unique properties and roles of these precious metals, investors can incorporate them into a diversified strategy to preserve and grow wealth, ensuring financial stability in an unpredictable world.